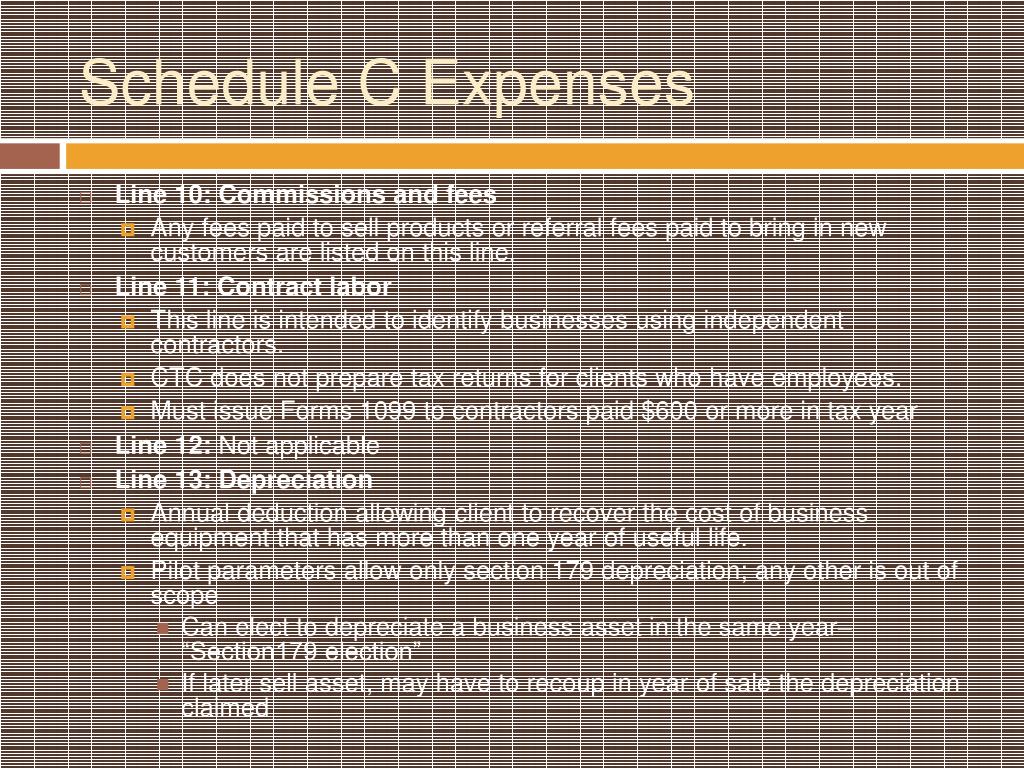

This is the question you should always ask yourself before expecting a tax write-off-if the answer is yes, you can often claim a deduction. "Is this an ordinary and necessary business expense?" A simple way to do this is to have credit cards and bank accounts that are solely for your business. The more you draw a clear line, the easier time you'll have claiming deductions. You can't write off the cost of your bed because you messaged a client from it. Tax deductions are only for business expenses. Those lines are often blurred when you're self-employed. The best ways to improve your bookkeeping: clearly delineating business expenses from personal ones. If you work out of a home office, you should have the dimensions of the workspace to calculate how much you write off. For instance, if you're driving for business you should record every trip's date, mileage, and purpose. Some deductions benefit from even more detailed record-keeping. This means keeping and organizing receipts for anything you consider to be a business expense required to perform your line of work.

Proper bookkeeping makes deductions infinitely easier to claim come tax day-it's also your first line of defense in case of an audit. So, before you make any big spending decisions banking on a tax deduction, here are some important guidelines to bear in mind. But if not done correctly, you run the risk of an IRS audit. There are scores of tax write-offs independent contractors and other self-employed workers can take advantage of. Essential tips for writing off deductions If you expect to owe more than $1,000 in taxes, you are generally required to make quarterly payments throughout the year. Unlike employees whose employers deduct taxes on their behalf, self-employed workers are responsible for making their own contributions based on their income. These make up self-employed workers' Social Security and Medicare contributions. The tax rate is calculated based on the past year's income. This is a requirement for all taxpayers, regardless of worker classification. In the US, independent contractors, sole proprietors, and other self-employed workers must pay:

What taxes do independent contractors have to pay?

#WHERE TO ENTER CONTRACTOR EXPENSES ON SCHEDULE C PROFESSIONAL#

While you should consult a certified public accountant (CPA), attorney, or another tax professional to get a comprehensive view of which expenses qualify, consider this your starter guide, complete with common write-offs to keep in mind and strategies for recording them. It pays for self-employed workers in the US to know what is and isn't tax-deductible. While a deduction won't provide a dollar-for-dollar refund for an expense, it’ll likely lessen the amount you owe to the IRS.

These deductions, also known as write-offs, are subtracted from your taxable income, which lowers your tax bill. The good news is that if you're an independent contractor, sole proprietor, or another form of self-employed worker, many of your business expenses are tax-deductible. Self-employed workers use their own equipment, find their own office space, and make their own retirement contributions.

0 kommentar(er)

0 kommentar(er)